Clawback Provisions that Go Beyond SEC Requirements are Prevalent Among Large-Cap Companies

By Stephen Hom, Erin Bass-Goldberg, Emma van Beek

Share

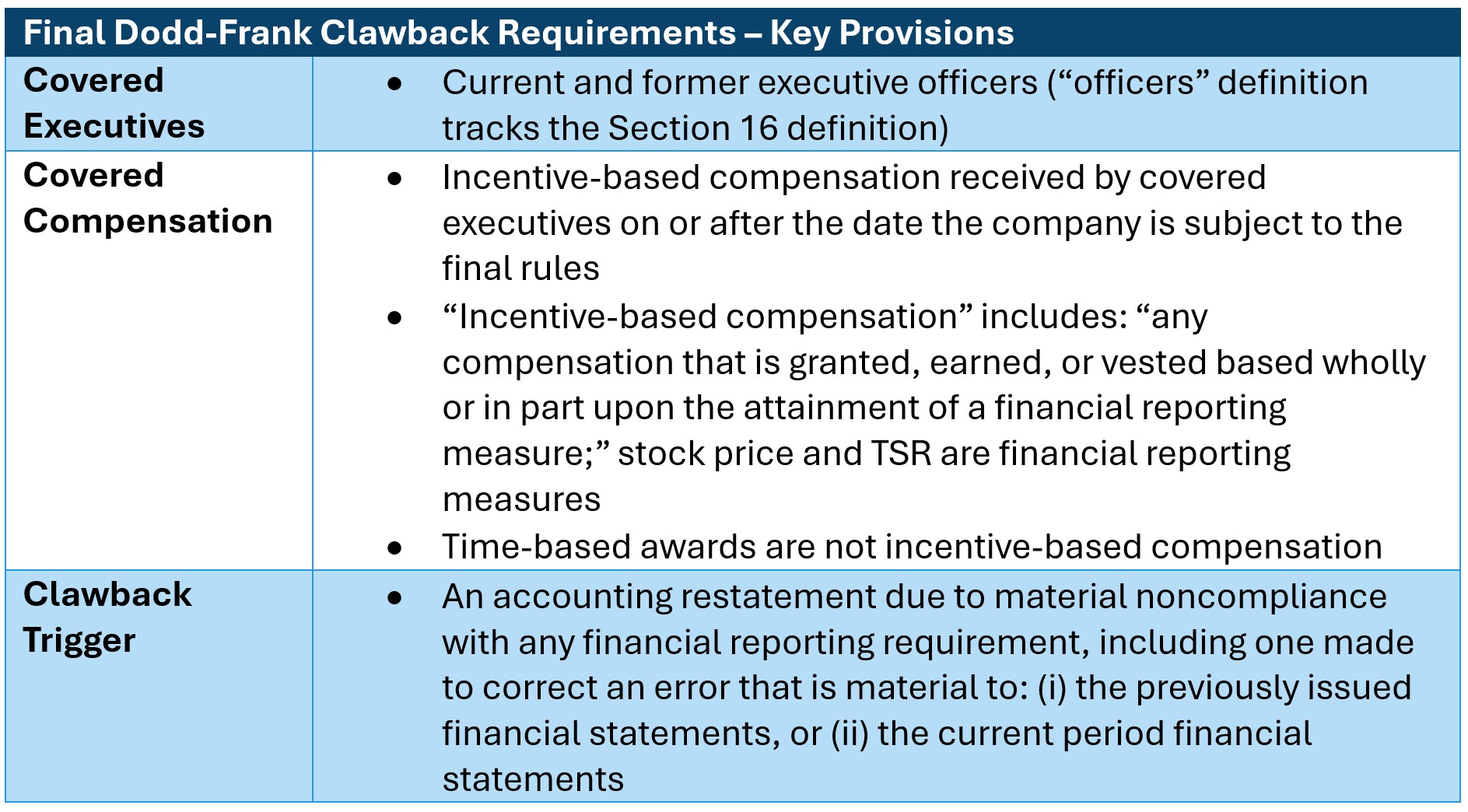

In October 2022, the SEC adopted final clawback rules mandated by the Dodd-Frank Act, which required companies listed on the NYSE and Nasdaq to adopt a clawback policy to recover excess incentive compensation from current and former executive officers in the event of a financial restatement.

Final listing standards went into effect on October 2, 2023 and required listed companies to adopt compliant clawback policies by December 1, 2023.

While waiting for the SEC to finalize the clawback rules, many companies voluntarily adopted clawback policies often with provisions that went beyond the Dodd-Frank Act requirements. For example, in response to high profile corporate incidents, some companies provided their boards with the discretion to clawback incentive compensation in the event of executive misconduct absent financial restatement.

With the SEC rules setting forth the minimums that companies must follow (see table below for more detail on SEC requirements), many companies evaluated their governance philosophies to determine whether to adopt or retain a more expansive clawback policy. Now that the 2024 proxy season is underway, there is data to determine whether companies merely adopted SEC-compliant policies, or adopted (or retained) more expansive policies that may cover a broader population, definition of compensation, and/or clawback triggers.

Survey Findings

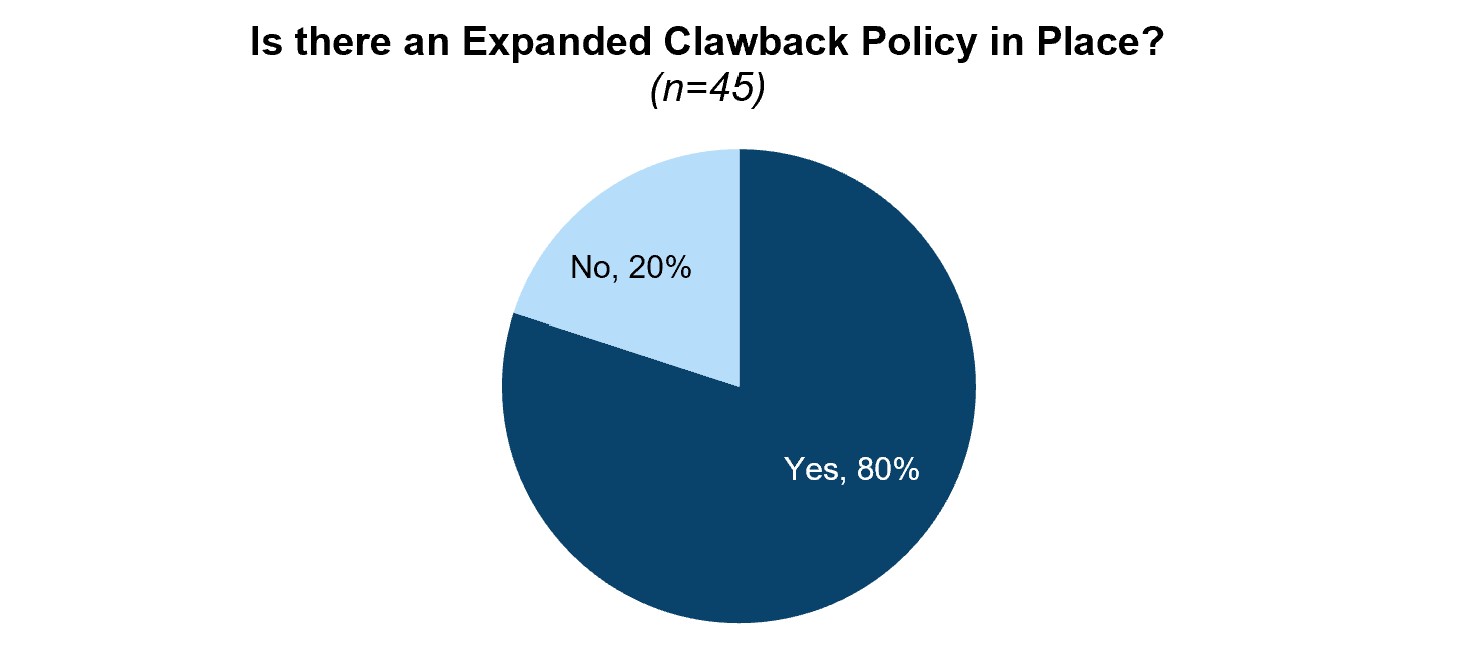

In an internal survey of practices among 45 large-cap companies (market capitalization greater than $10 billion), we found that 80% maintain an expanded clawback policy that goes beyond the SEC requirements1.

Unlike the SEC mandatory requirements, expanded clawback provisions typically provide for discretionary application.

Common features of an expanded clawback policy include:

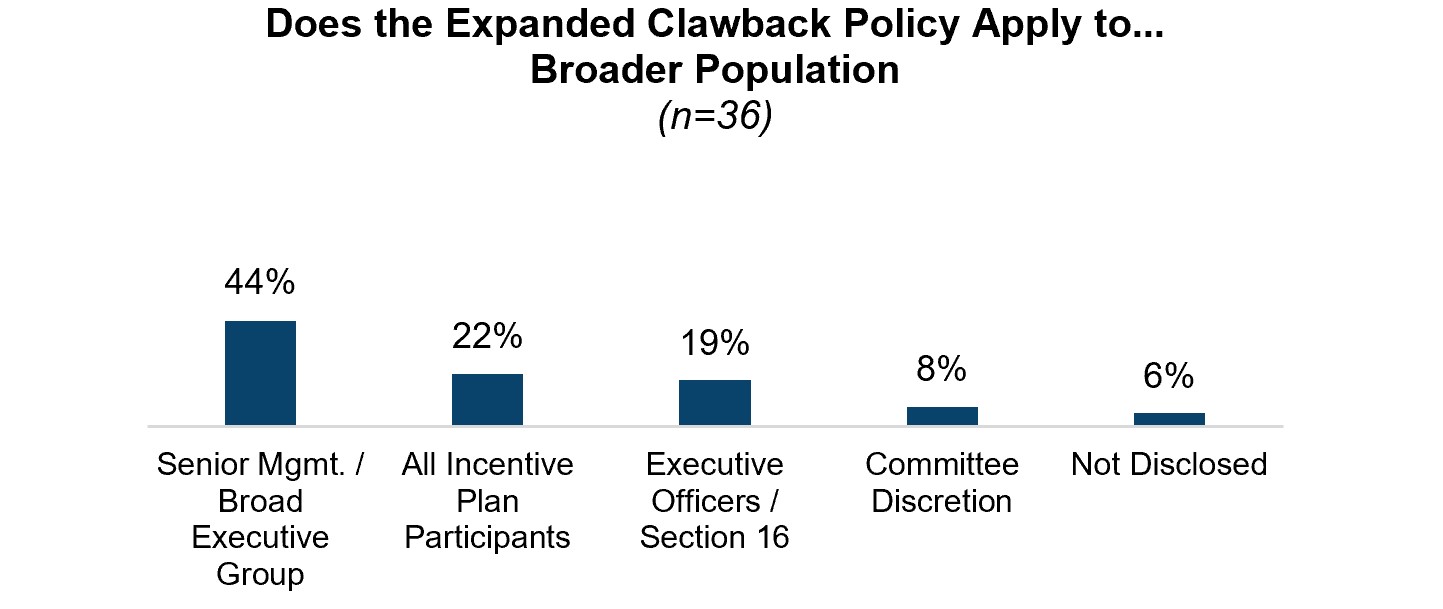

- Broader Population: 66% of the survey companies cover a broader population than SEC requirements, either by title (e.g., VP/SVP and above), coverage of all corporate officers, or the entire executive/leadership group

- Broader Compensation: With SEC requirements only mandating coverage of “incentive-based compensation”, 67% of the survey companies have expanded coverage to include broader types of compensation, such as all cash and equity incentives (including time-based awards)

- Broader Triggers: In addition to the SEC rules covering restatement-related clawbacks, expanded policies may include triggers absent a restatement, for example:

- Fraud or misconduct absent a financial restatement (64% prevalence)

- Reputational, financial, and other harm to the company (31% prevalence)

- Violation of company policy / code of conduct (25% prevalence)

Among the 20% of survey companies that only maintain a clawback policy that satisfies SEC requirements, one-third indicated an intention to review their policies soon and are considering adoption of an expanded policy.

Conclusion

Like many aspects of executive compensation, there is no one-size-fits-all approach when it comes to clawback policies. Companies and compensation committees should evaluate their own circumstances and governance philosophies to determine the best course of action. FW Cook will continue to monitor the market and provide any updates on significant developments through future postings.

(1) Our study did not distinguish between companies that already had expanded clawback policies in place prior to the adoption of their SEC-compliant policy versus companies that adopted newly expanded clawback policies.

(2) Clawback triggers related to financial restatements are included as it may apply to a broader population and/or compensation.

Stephen Hom

Stephen Hom

Principal

Stephen Hom works closely with clients across varying industries and specializes in incentive program design and compensation benchmarking. Stephen has fifteen years of executive compensation experience across his time with FW Cook and through prior roles in the human resources function of several large financial services and consumer goods companies. Given his background, he provides clients with a unique perspective on executive compensation issues and trends.

Erin Bass-Goldberg

Erin Bass-Goldberg

Managing Director

Erin Bass-Goldberg serves as the independent advisor to the Compensation Committees of both public and privately-held companies in various industries. Her consulting engagements focus on development of executive compensation strategy, design of annual and long-term incentive programs, and transaction-related executive compensation issues. She is an author and frequent contributor to the firm’s technical papers and studies, and is a speaker on executive compensation issues.

Emma van Beek

Emma van Beek

Consultant

Emma van Beek's main duties involve performing market research and evaluating compensation structures, researching incentive programs, and assessing market trends. Emma joined FW Cook four years ago after completing her studies at the University of Virginia. Her experience includes developing incentive programs, conducting pay-for-performance evaluations, creating custom peer groups, and developing compensation packages.