Equity Determination Amidst Stock Price Volatility: Analysis of Recent Technology IPOs

By Alyssa Imelio, Dana W. Etra, Lauren Shatanof, Stephanie Lane

Share

This is the first in a series of blog posts examining equity practices of technology and technology-enabled companies that IPOed during 2020 and 2021.

Introduction

In the face of stock price volatility, determining the size of equity awards can be a challenging task for companies. Swings in stock price can result in substantial changes in the number of shares delivered year-over-year as well as high equity burn rates and subsequent share plan reserve challenges. Given the market volatility observed in recent years, companies susceptible to such market dynamics, including many companies that made their public debut in 2020/2021, are proactively adopting strategies that mitigate significant fluctuations in equity award sizes and annual share usage.

Market Practice

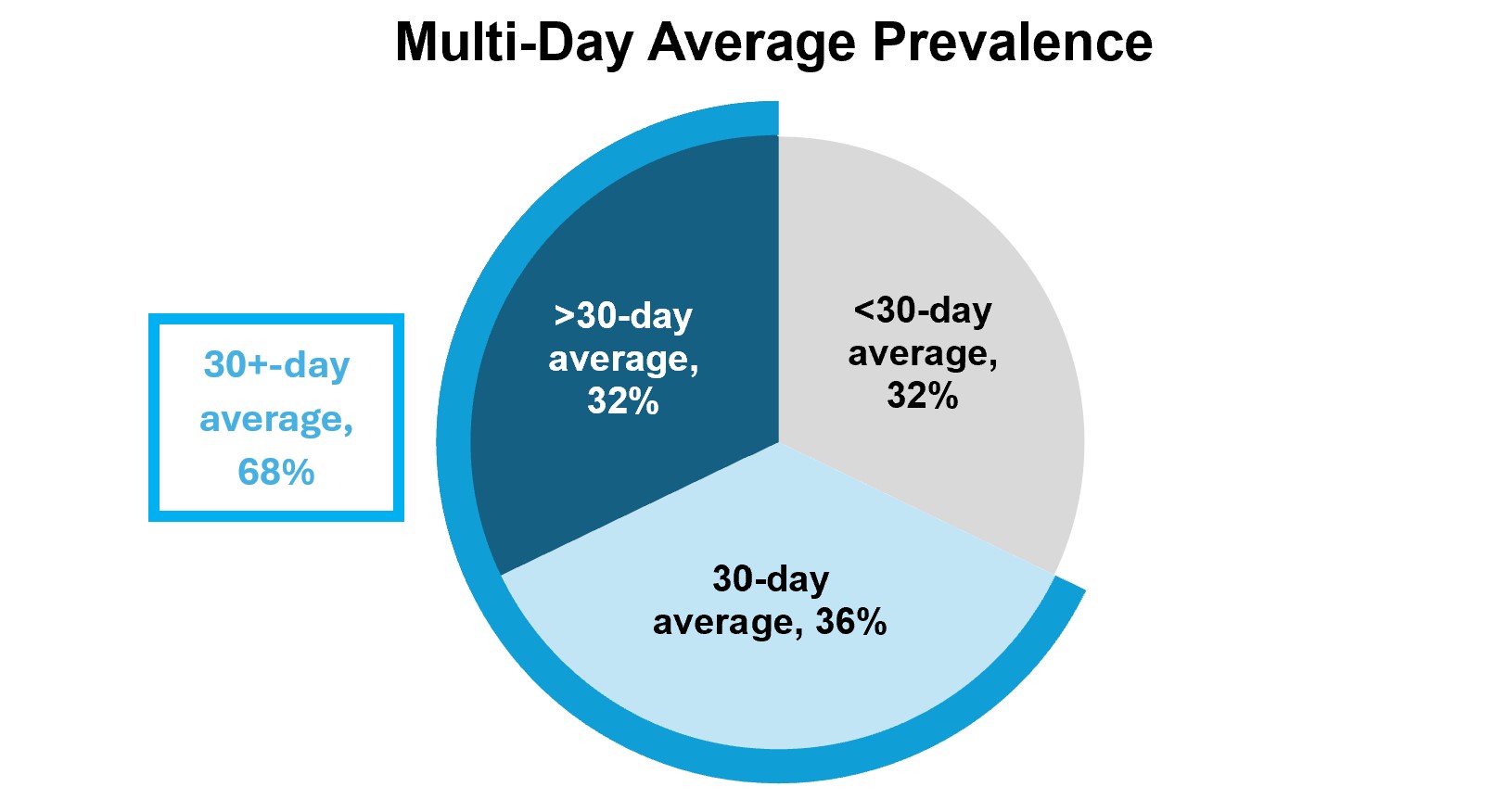

Most publicly traded companies employ a value-based approach to communicate the annual equity compensation opportunity to participants. A target value is established for each participant, and the number of shares is determined by dividing the target value by a per-share stock price. FW Cook’s research indicates that many recently public companies are using a multi-day average stock price (e.g., 30-day average) when determining grant sizes to mitigate the impact of stock price volatility instead of relying on a single spot price.

FW Cook analyzed the practices of US-based technology and technology-enabled companies that IPOed during 2020 and 2021, excluding companies with <$100M market cap at IPO. Of companies where the equity determination approach can be identified (n = 85), 45% use the price on grant date close and 55% use a different price, typically a multi-day average to convert LTI value into a number of shares. Of those that used and disclosed a multi-day average, most utilized a 30-trading-day or longer averaging period. While incorporating the average price introduces an additional step into the grant process, some companies end the averaging period a few days before the grant date to alleviate administrative needs.

Use of a multi-day average typically results in a discrepancy between (1) the fair value of awards for proxy tabular disclosure purposes, and (2) the target value communicated to the award recipient. To mitigate potential confusion among recipients, a more detailed internal communication plan may be required to ensure that recipients understand that the discrepancy between their target award value and the value in their stock plan account is due to the design of the program rather than a calculation error.

Use of a multi-day average typically results in a discrepancy between (1) the fair value of awards for proxy tabular disclosure purposes, and (2) the target value communicated to the award recipient. To mitigate potential confusion among recipients, a more detailed internal communication plan may be required to ensure that recipients understand that the discrepancy between their target award value and the value in their stock plan account is due to the design of the program rather than a calculation error.

Additional Strategies

While use of a multi-day average is one approach to address the impact of market volatility on grant sizes, other alternatives are available. Companies may choose to cap award values to work within a share usage budget to address share plan constraints, or simply keep the number of shares granted consistent with the prior year’s grant. If share availability constraints arise, companies may also choose not to grant annual awards to the total eligible population and instead target a subset of the eligible population (e.g. high performers or key retention concerns).

Conclusion

Proactively implementing strategies to navigate stock price volatility allows companies to maintain more stable equity award sizes and effectively manage their stock plan reserves, fostering greater predictability and fairness within their equity compensation programs. That said, companies choosing to employ a volatility mitigation strategy such as multi-day stock price averaging or limiting the portion of the employee population receiving grants should be aware of the potential employee relations and administrative challenges associated with these strategies.

Alyssa Imelio

Alyssa Imelio

Consultant

Alyssa Imelio provides support and advice to a wide variety of companies and specializes in designing short- and long-term incentive plans, peer group development, performance metric selection, and corporate governance. In addition to working on project teams for public companies, Alyssa has supported clients across a wide range of industries, sizes, business structures, and development stages including several traditional and SPAC IPOs, helping to facilitate the transition from private to public by developing meaningful and retentive compensation programs.

Dana Etra

Dana Etra

Managing Director

Dana Etra advises boards and management teams across industries and has broad experience consulting to companies in varying stages of the business cycle on executive and board compensation. She works with clients on all aspects of compensation strategy and program design, including corporate governance considerations and tax, accounting, securities law, and other regulatory implications.

Lauren Shatanof

Lauren Shatanof

Consultant

Lauren Shatanof provides personalized and ongoing support to public, Pre-IPO / SPAC, and private clients in a variety of industries with a focus on life sciences and technology companies. Her work covers matters relating to annual and long-term incentive plan design, executive and non-employee director compensation, peer review analyses, company specific compensation philosophies, severance and change in control agreements, pay-for-performance evaluations, and governance trends and best practices.

Stephanie Lane

Stephanie Lane

Consultant

Stephanie Lane provides advice and ongoing support to clients across a range of industries and business lifecycle phases. Her work covers all aspects of total compensation strategy, including incentive plan design, proxy disclosure, executive and non-employee director compensation, peer review analyses, compensation-related governance, and severance and change in control agreements.