ISS Announces 2025 Policy Updates and Releases New FAQs

Share

On December 17, 2024, ISS published an executive summary of its proxy voting policy updates for annual shareholder meetings held on or after February 1, 2025. Executive summaries of the policy updates for US companies can be found here and here with the full updated 2025 proxy voting guideline expected to be published in January. For 2025, there are no US voting policy changes related to executive compensation. However, ISS did update the supporting policy documents to further clarify how it evaluates and applies existing compensation policies, and if there are any changes in approach for the upcoming year. The updated 2025 supporting policy documents (i.e., Executive Compensation Policies FAQs, Equity Compensation Plans FAQs, Peer Group Selection Methodology FAQs, and Pay-for-Performance Mechanics document) can be found at the ISS Policy Gateway with updates of potential interest highlighted below:

Executive Compensation Policies FAQs

- Realizable Pay: ISS stated that, effective Feb. 1, 2025, realizable pay charts will not be displayed in the proxy research reports for companies that had two or more CEO changes within the 3-year measurement period.

- Performance-Vested Equity: In November 2024, ISS released proposed benchmark policy changes that included a potential update for 2026 or later that could soften ISS’s negative stance on the heavy use of time-vested equity awards (e.g., greater than 50% of the regular annual grants for NEOs). In anticipation of this potential future policy change, ISS is adapting its approach to the qualitative review of performance-vesting equity awards. Beginning with the 2025 proxy season, ISS’s qualitative review will place greater focus on the disclosure and design of performance-based equity grants, particularly for companies that exhibit quantitative pay-for-performance misalignment. Any design or disclosure concerns regarding performance equity will carry greater weight in the qualitative analysis, and significant concerns in these areas will be more likely to drive an adverse say-on-pay recommendation for a company that exhibits quantitative pay-for-performance misalignment. Potential qualitative design or disclosure concerns include (a) not disclosing forward-looking goals, (b) poor disclosure of closing-cycle vesting results, (c) poor disclosure of the rationale for metric changes, metric adjustments or program design, (d) unusually large pay opportunities (including maximum vesting opportunities), (e) non-rigorous goals that do not appear to strongly incentivize for outperformance, and (f) overly complex performance equity structures. Multiple design or disclosure concerns will be more likely to result in an adverse vote recommendation.

- Evaluation of Performance Metrics: ISS formalized how it evaluates the choice of incentive metrics and the factors it considers including (a) whether the program emphasizes objective metrics that are linked to quantifiable goals, as opposed to highly subjective or discretionary metrics, (b) the rationale for selecting metrics, including the linkage to company strategy and shareholder value, (c) the rationale for atypical metrics or significant metric changes from the prior year, and/or (d) the clarity of disclosures around adjustments for non-GAAP metrics, including the impact on payouts. It is reasonable to assume that by publishing these factors, ISS could treat the lack of sufficient and transparent metric disclosure as an unfavorable consideration in its qualitative review.

- Mid-Cycle Award Modifications: ISS added a new FAQ confirming its negative view of mid-cycle modifications to in-progress incentive programs. Companies should disclose clear and compelling rationale for such actions and explain how they do not circumvent pay-for-performance outcomes.

- Clawbacks: ISS clarified that in order to receive credit for a "robust" clawback policy in the proxy research report, a company's clawback policy must explicitly cover all time-vesting equity awards. A clawback policy that adheres only to minimum Dodd-Frank Act requirements will not be considered robust, because those requirements generally do not cover all time-vesting equity awards. This clarification aligns with the standard applied when determining if points are earned under ISS’s Equity Plan Scorecard model used to evaluate equity plan proposals.

- Equity Treatment Upon Change in Control: ISS expanded its Say-on-Golden Parachutes FAQ regarding the evaluation of the treatment of equity awards upon a change in control to explicitly state that full single-trigger accelerated vesting is viewed negatively and pro rata double-trigger vesting is best practice. Previously, ISS simply stated that pro rata vesting is best practice with no mention of trigger type.

- COVID-Related Pay: ISS eliminated an FAQ related to COVID-related pay decisions.

- Non-Employee Director Compensation: ISS moved FAQs related to non-employee director pay policy to the US Procedures & Policies (Non-Compensation) FAQ document.

Equity Compensation Plans FAQs

- ISS made no changes to the Equity Plan Scorecard (EPSC) model for 2025, which is the model used by ISS to determine its vote recommendation for most equity plan proposals. In general, proposals subject to the EPSC will continue to be scored on factors that fall under three pillars (Plan Cost, Plan Features, and Grant Practices) and must meet a threshold passing score to receive ISS support. The threshold passing score is 59 out of 100 points for S&P 500 companies, 57 points for other Russell 3000 companies, 55 points for non-Russell 3000 companies, and 53 points for Special Cases.

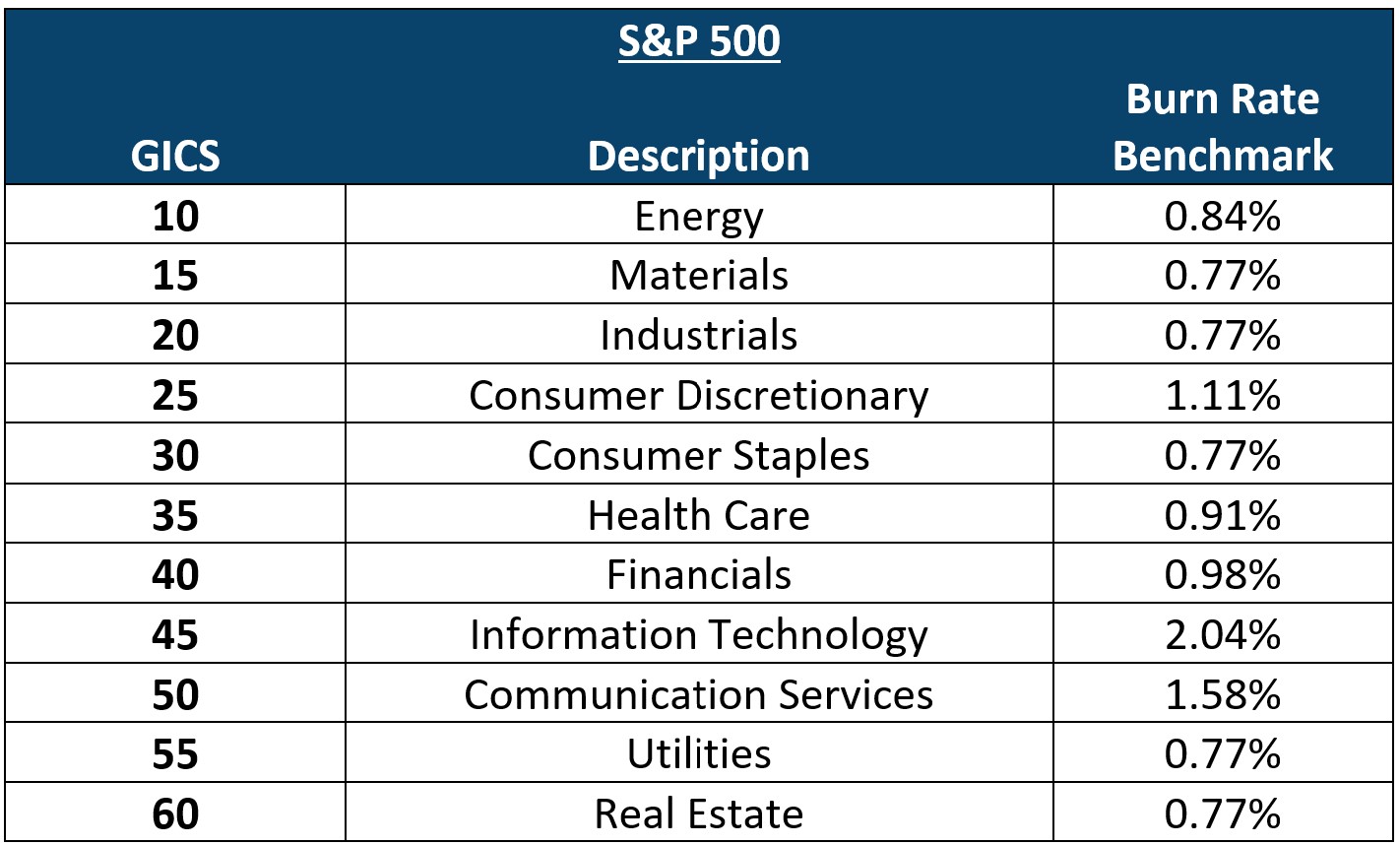

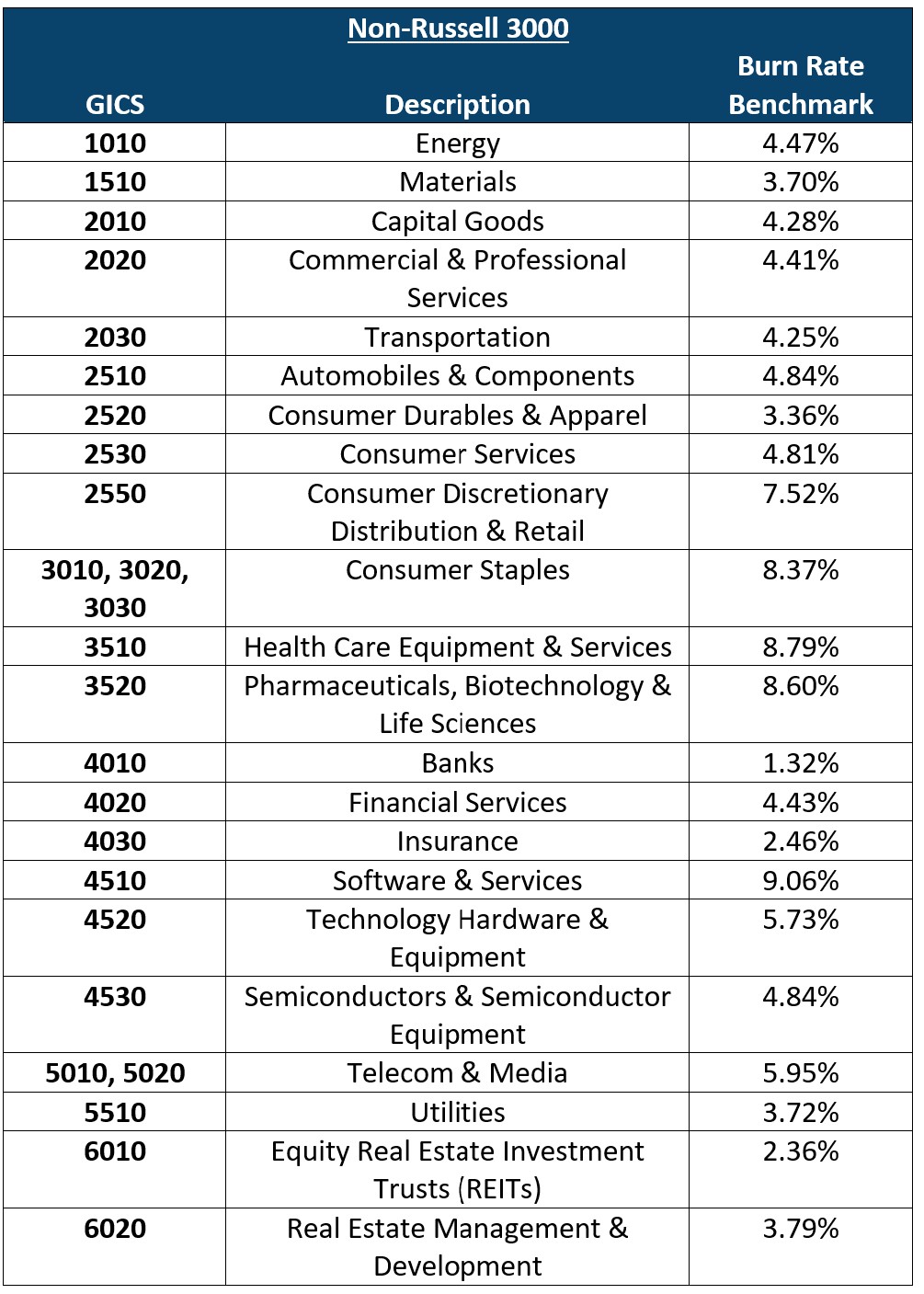

- However, the Value-Adjusted Burn Rate Benchmarks applied under the EPSC model have been updated for 2025 and are provided below (note that the burn rate benchmarks are subject to de minimis thresholds: 0.77% for the S&P 500; 1.05% for the Russell 3000 excluding the S&P 500; and 1.23% percent for the non-Russell 3000, which are unchanged from last year):

Pay-For Performance Mechanics

- ISS made no changes to the quantitative Pay-for Performance model for 2025, which is the primary model used by ISS to identify pay-for-performance misalignment when determining its vote recommendation on say-on-pay proposals.

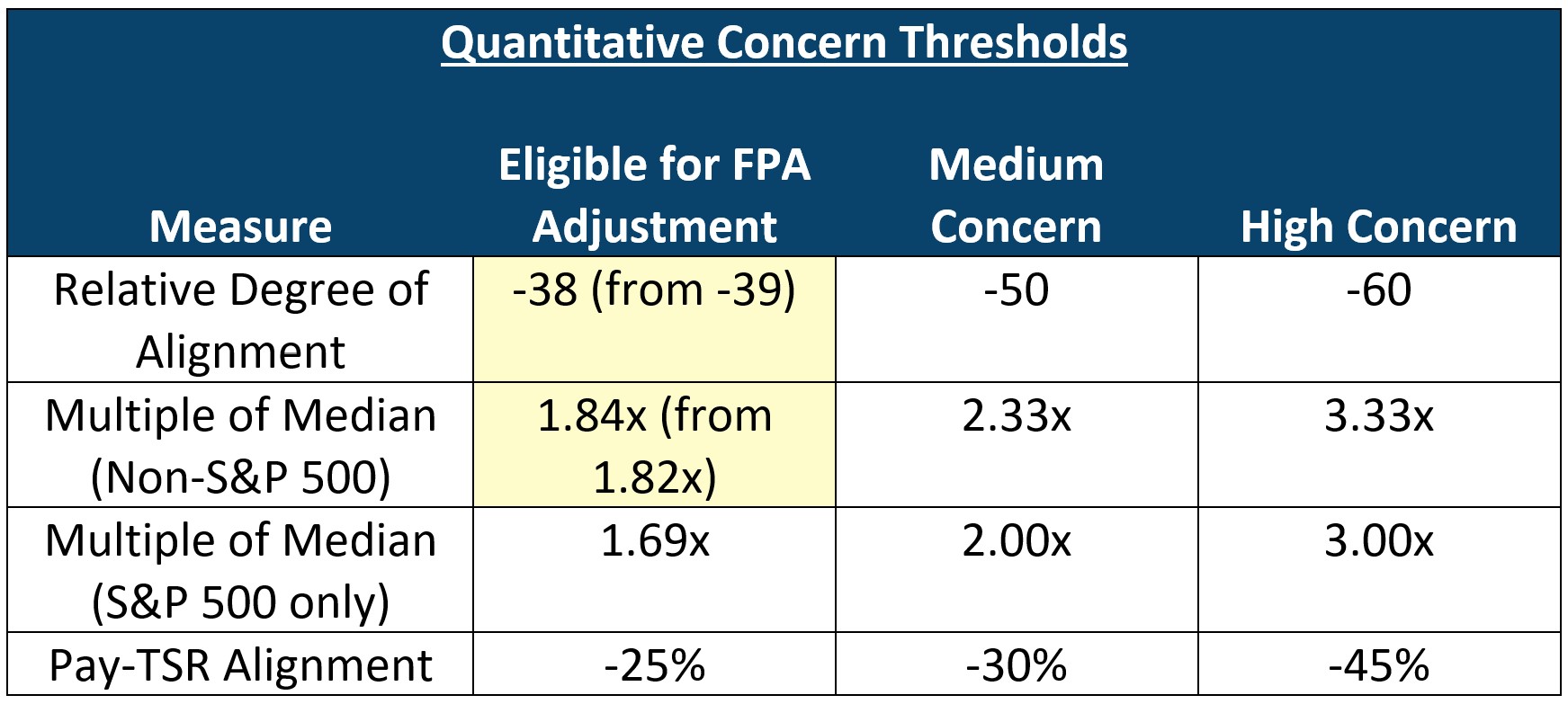

- However, the Concern Thresholds applied under their quantitative pay-for-performance tests have been updated for annual meetings beginning February 1, 2025. Threshold changes from 2024 are highlighted in yellow in the table below.

David Yang

David Yang

Managing Director

David Yang has advised numerous public and privately-held companies on all aspects of executive and board compensation. His experience covers a wide range of industries, including healthcare, financial services, retail, consumer products, transportation, and technology among others. He is a frequent speaker on executive compensation topics and a regular author of the firm’s alert letters.

Brian Walsh

Brian Walsh

Consultant

Brian Walsh consults on all aspects of executive and board compensation, specializing in market research, total compensation design, peer group analysis, and financial performance analysis.