Alert

|

July 19, 2024

FASB Proposed Acccounting Standards Update on Income Statement Expense Disaggregation Disclosure

By

Stafford Schmidt, Michael Abromowitz

Share:

Read the full Alert below or download here.

The Financial Accounting Standards Board (FASB) completed discussions and voted to proceed to drafting a final version of the proposed Accounting Standards Update (ASU) for the disaggregation of income statement expenses (DISE) on June 26, 2024. The finalized ASU is expected to be issued in the fourth quarter of 2024 and take effect in 2027 for most companies. This memo focuses on the required break-out of employee compensation and related implications.

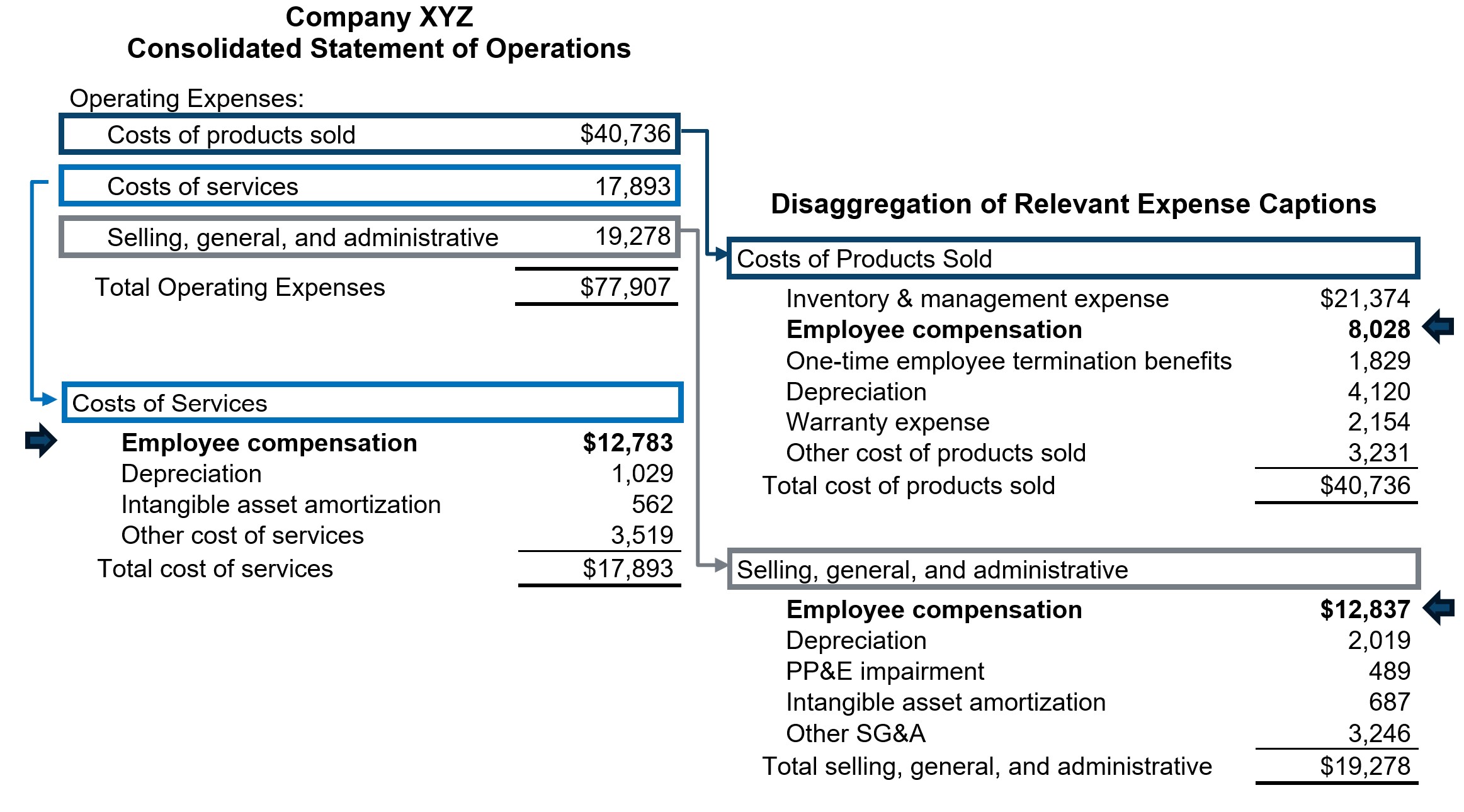

DISE mandates a tabular footnote disclosure of several expense categories that had not previously been broken out for shareholders. Employee compensation will be disclosed as a component of each applicable income statement expense, although individual compensation elements are not required to be disclosed separately (e.g., salaries, bonus, share-based compensation1, benefits, etc.). As such, DISE will provide new information on the extent to which a company’s recognized expenses are attributable to employee compensation but will not provide insight into the underlying elements.

DISE requires public business entities to provide tabular disclosures in financial statement footnotes that detail expenses in a new format. The new disclosure pertains to income statement expenses from continuing operations, covering any of the following five categories:

- Inventory & manufacturing expense

- Employee compensation

- Depreciation

- Intangible asset amortization

- Depreciation, depletion & amortization recognized as a part of oil- and gas-producing activity

Additionally, one-time employee termination benefits are required to be presented as a distinct line item, separate from employee compensation.

FASB defines “employee compensation” as “all forms of cash consideration (including deferred cash compensation), share-based payment arrangements, medical care benefits, pension benefits, postretirement benefits, and nonretirement postemployment benefits for services rendered by employees or for the termination of employment.” The definition of employee compensation is generally consistent with accounting guidance and mixes both cash compensation and multiple years of equity and other compensation cost recognition (e.g., equity expense is recognized over the vesting term, which may reflect multiple years of grants).

Subject to modifications adopted in the final rule-making stage, the disclosures mandated by DISE will be effective for fiscal years beginning after December 15, 2026, and for interim periods within fiscal years starting after December 15, 2027; early adoption is permitted. The ASU would be implemented on a prospective basis, though entities have the option to apply DISE retrospectively.

The example below illustrates a condensed breakdown of the new DISE disclosure, providing new employee compensation information from multiple income statement expense items:

1This disclosure requirement is in addition to the aggregate share-based compensation expense value which is already a requirement in the financial statements of a company’s annual report.

1This disclosure requirement is in addition to the aggregate share-based compensation expense value which is already a requirement in the financial statements of a company’s annual report.

Share: